How to optimize payment terminal life cycle ?

Make the right decisions at the right time to optimize your terminal life cycle

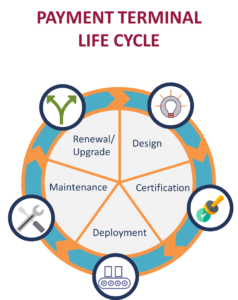

There are many stages in a payment terminal life cycle, and payment solution providers must define their strategy at the earliest durign the development of their solution to avoid wasting time and money.

What are the different cycles in a payment terminal's life ?

- design and development : define the hardware and software components

Right from the designing stage, card readers are built to embed payment software functionalities and security features according the targeted market it has been conceived for ; public transport network, unattended fuel distribution, mobile POS solution or vending machine.

Specifications edited by EMVCo and other payment schemes define the configurations of the embedded kernels which must behave according the type of transaction performed.

- certification : to be officially validated

Once the development stage is completed, the device must be submitted to EMV and payment schemes type approval to prove its compliance with the specifications of the contactless payment applications it supports. A Letter of Approval will be granted for a defined period of time, according each payment scheme. EMV compliant devices must also be submitted to PCI security evaluation to be officially listed as secure card readers.

The challenge for payment solution providers at this stage is to optimize certification cost and time. The integration of verified functional payment software and automation testing are two elements to fast track certification processes.

- deployment and maintenance : when your product is officially live

After the required certifications are successfully passed, the payment card reader is ready to be deployed. Then efficient maintenance operations and device fleet management are essential. It ensures their correct behavior in the field and drives a positive user experience.

Renewal VS recertification : how to choose ?

This turning point in payment terminal life cycle is often not anticipated by manufacturers, because they might not be aware of the regular updates and changes in the specifications requirements.

Indeed, at the time of certification of level 1 and level 2 functional kernels, LoAs’ state the validity period, often limited to 3 or 4 years. At the end of this validity period, the product provider shall either decide to request a renewal statement for the device, or enter full certification process again. This choice is mainly based on the changes operated on the device and the evolutions of the specifications.

How to make the right decision between renewal and recertification ?

Before making a decision, it is crucial to analyse the current functionalities of the solution in comparison with the latest test plan available. Basically, if the product has not undergone hardware changes, and the actual certified kernel proves sufficient compliance with the latest test plan requirements, then a renewal LoA can be granted. Be careful though ! At the end it mainly depends on payment schemes’ decision to grant renewal, and they might require delta testing to prove that the kernel complies with the current requirements.

Sometimes a major evolution in the specification requires that the product be updated with the latest specification, and then must be submitted to a new full certification, before the end of the validity period, to be maintained in the field.

An efficient payment product life cycle strategy shall be defined at the earliest stage of the project. It allows to be proactive at each step of your product development, and to efficiently manage your costs ; for development, certification, production, and maintenance.

Many actors in the innovative payment solution procurement are new to the payment ecosystem and may not anticipate the many steps and hurdles that they will face during the development of their payment solutions. Technological partnerships can help them to reduce costs, shorten development lead time, and accelerate time-to-market.

Alcinéo provides secure digital payment solutions to help payment terminal providers to optimize their products life cycle. We share our know-how and expertise to help our customers define the best strategy to maintain their solutions in the field and ensure they are still in line with international standards requirements.

Get more information about our products and solutions to help you adopt the right strategy for your product development :